© Shutterstock – 1060050803

Investigation

Berlin Risk offers a portfolio of corporate intelligence solutions, which can be tailored precisely to meet the challenges of your project.

Decision-makers need to know as much as possible about the integrity of their partners and prospective projects in order to navigate risks and achieve the best results. Our corporate investigations team gathers, scrutinises, deciphers and analyses information from all available public materials, as well as our discreet network of sources. In the case of fraud, misconduct or misappropriation of funds, Berlin Risk offers investigative support.

Corporate Investigation

Berlin Risk´s Corporate Investigations team assists clients in meeting strategic, compliance and corporate governance requirements, and helps them avoid costly reputational damage.

Our Due Diligence services provide you with key reputational and integrity intelligence to help you in your business decisions – for example with regard to a new market entry, a new partnership, a corporate bid or merger, the appointment of a new management team or the overhaul of an existing team.

The introduction of demanding regulation and far-reaching anti-corruption and anti-money laundering legislation has increased companies’ responsibility to protect their institutions and stakeholders from illegal activity and unethical business practices. Berlin Risk has been increasingly contracted to carry out fraud and corruption prevention projects at a pre-transaction stage. This is especially crucial in emerging markets, where our due diligence expertise helps clients avoid the risks stemming from mismanagement, fraud, embezzlement, corruption and other financial crimes.

Berlin Risks also offers litigation and investigation support when incidents of fraud are uncovered or have been reported through whistle-blowing hotlines. We develop bespoke investigation strategies and conduct research, including on-the-ground investigations, to collect the facts.

Case Study

A financial institution was seeking to invest in a high-risk jurisdiction and was considering relationships with three companies. Berlin Risk was tasked to assess the risks attached to the three companies, including any financial crime and political risk exposure that might impact upon the client’s reputation by association.

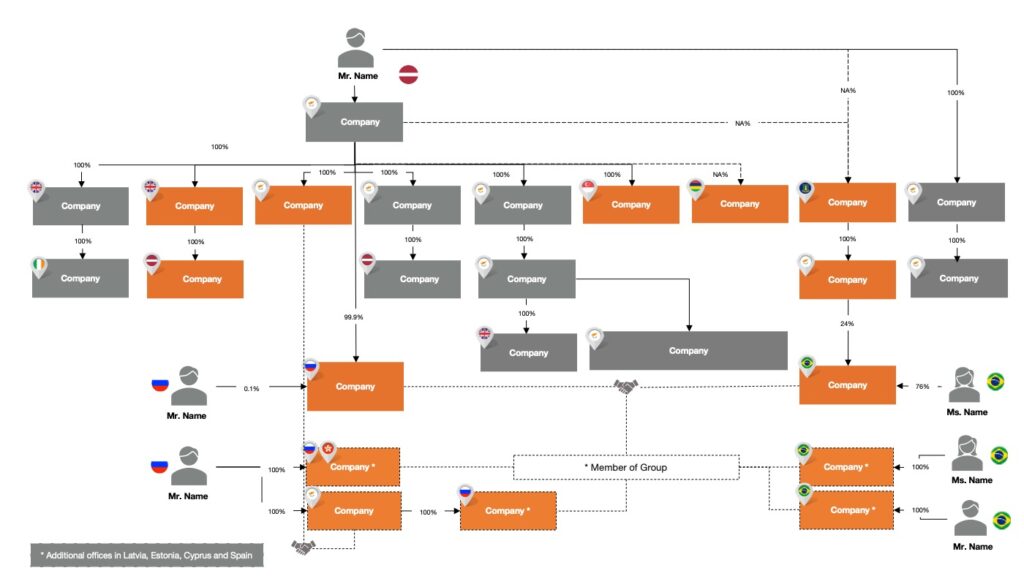

The investigation involved a detailed analysis of the potential partners by means of research and enquiries, and the preparation of a relationship chart outlining the ownership structures and links to politically exposed persons.

This allowed for an assessment of the three companies’ overall reputation and standing, business practices, corporate governance standards, as well as the integrity of their management and shareholders.

At the end of the process, the client was presented with a risk assessment of all three entities using Berlin Risk’s Reputational Risk Meter. They were able to use this as a basis from which to engage in a discussion of the potential risks and make sound risk-based decisions.

Fraud Investigation

Berlin Risk has conducted multiple financial crime and fraud investigations as well as forensic audits worldwide. Our investigations include incidents of corruption, money laundering, misappropriation of company funds, as well as investigations surrounding the violation of agreements, contract disputes, asset recovery, intellectual property violations and other regulatory issues.

Our certified fraud examiners, investigators and computer forensic experts investigate the situation with you and develop remediation measures. All investigations comply with local laws and regulations, and best practice standards form the basis of our work.

We fully understand the need for discretion and confidentiality, and meet all security and data protection requirements when collecting, analysing and reporting on information.

Berlin Risk also provides advice on how organisations can improve their control frameworks and strengthen governance mechanisms. This includes the use of risk mitigation measures that are industry best practices.

Case Study

A client had identified large-scale misappropriation of company funds via a complex structure of corporations registered in a number of different jurisdictions. Senior executives appeared to be involved in the fraud.

Berlin Risk was engaged to undertake an internal investigation and external research in support of the internal audit function and legal counsel.

By the end of what proved to be an extensive investigation, the client had developed a strong legal case against the subjects implicated in the illegal activity. Working together with computer forensic and data mining experts, key evidence was secured. Ultimately, the client was able to freeze a significant portion of the misappropriated funds.

Following the investigation, Berlin Risk assisted the client in undertaking a company-wide risk assessment to improve resilience going forward. We made recommendations to help the client improve its overall fraud risk management programme, and to strengthen its fraud prevention and detection control activities.

Due Diligence

Our due diligence practice includes integrity due diligence, sanctions and ESG due diligence. We help you meet regulatory requirements.

Advisory

We can help businesses operating internationally to analyse and assess the political and regulatory risks at the national and sector levels in the regions in which they operate.