© iStock – 842337926

Due Diligence

Our due diligence practice includes integrity due diligence, sanctions and environmental, social and governance (ESG) due diligence. We help you meet regulatory requirements in relation to anti-financial crime, governance and corporate social responsibility, while also helping you to protect your institution and stakeholders from illegal activity and unethical business practices.

We offer:

- A bespoke research method

- Tailored investigations

- Discreet on-the-ground enquiries

- Cross-verification of allegations

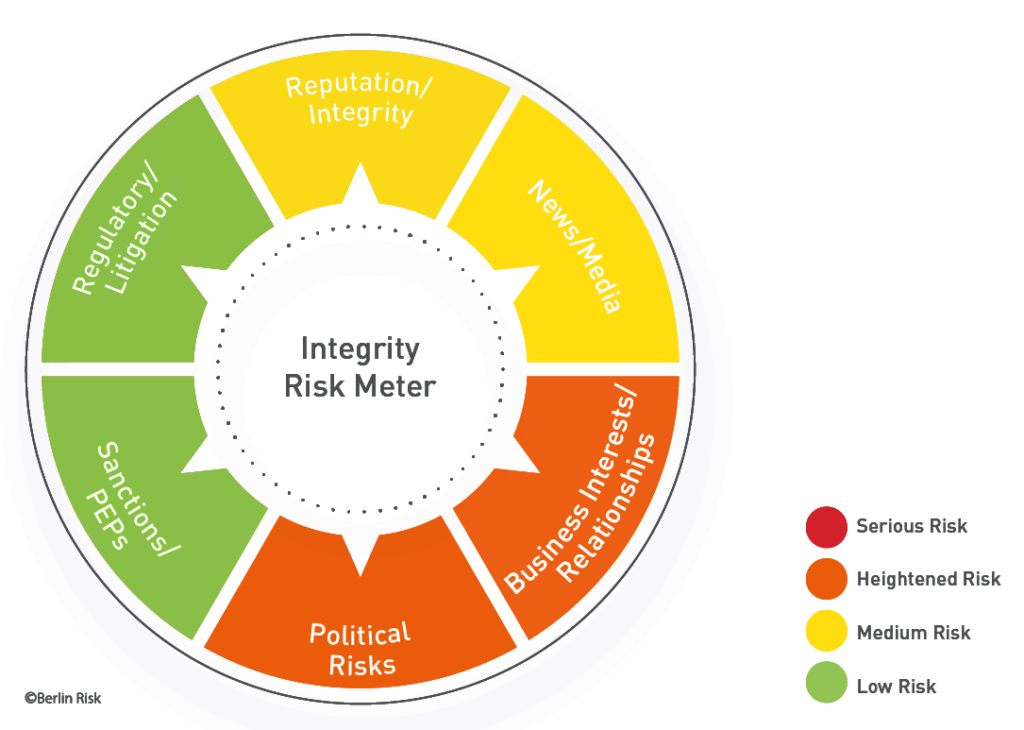

Our proprietary Reputational Risk Meter, and Integrity Risk Assessment System provide you with an additional layer of objective analysis that facilitates and supports your risk-based decisions. Relationship mapping is another key feature of our investigations, and helps provide clear analysis of complex shareholding structures and personal networks.

Integrity Due Diligence

Identifying the right business partners remains a key challenge for companies and organisations. By gathering independent information, we help you understand and assess the integrity risks associated with the people and entities you are doing business with.

We provide systematic background checks and investigate any issues of concern relating to:

- Ultimate beneficial ownership

- Origins of funds and wealth

- Criminal proceedings

- Economic sanctions

- Involvement of politically exposed persons (PEPs)

- ESG issues

- Supply chain risks

We know how to place our findings in context, and our team of experts is adept at understanding the challenge of working in high-risk countries. Our proprietary Reputational Risk Meter and Integrity Risk Assessment System provide you with an additional layer of objective analysis that facilitates and supports your risk-based decisions. Our risk rating system also helps assess the extent to which relevant issues of concern are manageable.

Case Study

A development institution was looking to invest in a company in an Eastern European country that is not a member of the EU. Although the sector the company operated in – production of construction materials – was clearly strategically interesting for the client, indications of criminal structures and corrupt practices created cause for concern. Moreover, the company’s beneficial ownership was not transparent, it had been involved in several litigation cases, and there was reason to believe it had an elevated sanctions risk exposure.

Berlin Risk undertook enhanced due diligence of the target company, its ultimate beneficial owners and its associates, to assess the risks attached to the project. A systematic analysis of the target entity included building a relationship map by means of open source research in several languages and enquiries with more than 15 on-the-ground sources to establish the company’s reputation and any related issues of concern.

Based on the results of the investigation, we advised the client on risk mitigation measures to enable a secure business relationship. We also equipped the client with strategies to help it to monitor this relationship over time.

Sanctions Due Diligence

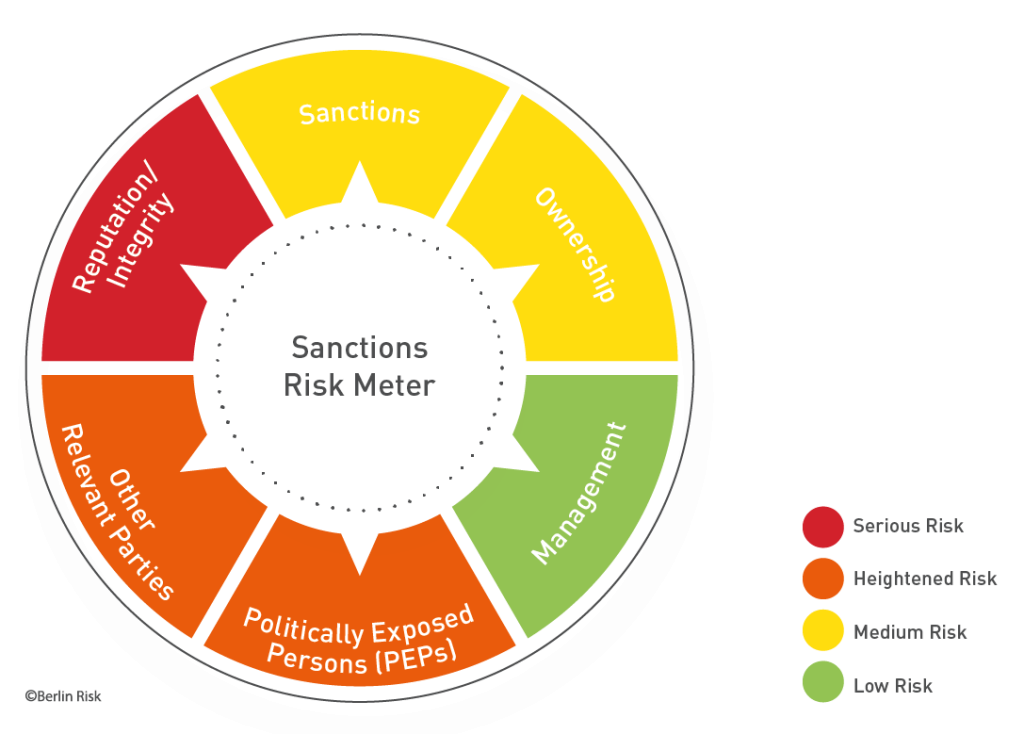

Berlin Risk’s experts provide sanctions due diligence reports and sanctions advisory services to financial institutions and corporations looking to engage in markets impacted by UN, US and EU sanctions regimes.

The complex context around sanctions regimes requires in-depth insights into the risk exposure of individuals and entities to existing or potential sanctions. These risks can be direct or indirect and can shift over time depending on political developments.

Our country and sanctions specialists can provide contextual analysis and insights to organisations looking to navigate the regulatory landscape and mitigate their sanctions risk exposure.

Case Study

A consortium of international banks was examining the possibility of providing financing for the construction of a large industrial facility in Russia (before the invasion of Ukraine).

Berlin Risk was asked to provide a sanctions risk assessment of the Russian company that owned the future facility, as well as of its shareholders and other relevant parties. The goal of the exercise was to consider and assess the risk factors that could contribute to the parties in question becoming targets of sanctions, rather than assessing scenarios under which such sanctions could be introduced.

While the Russian corporate owner of the project itself was not under sanctions at the time, research established that some of its shareholders and managers were specially designated nationals (SDN), and others were under the US sectoral sanctions (SSI) or were politically exposed persons (PEPs).

Berlin Risk carried out an assessment of the sanctions risk for the above parties based on several criteria, including existing sanctions exposure through ownership and operations, overall political exposure, as well as track record and reputation. The client received an individual designation risk forecast for every entity and individual deemed relevant for the project.

ESG Due Diligence

Berlin Risk supports clients in managing reputational risks attached to environmental, social and governance (ESG) matters.

It is increasingly widely accepted that a company or financial institution needs to be compliant in all three ESG subjects in order to ensure that they operate a responsible and sustainable business.

Our issues-based approach identifies and assesses incidents involving environmental pollution, loss of biodiversity, human rights violations or labour discrimination in much the same way as we report on indications of corruption and financial crime. In our experience, issues in one area are often indicative of issues in other ESG-related areas.

Clients that engaged our services well before the terms ‘responsible business conduct’ and ‘ESG’ were coined have distinguished themselves by acting responsibly in these areas. The long-term success of a business requires a sustainable strategy that takes the involvement of multiple stakeholders into consideration.

What was once considered a pioneering approach has become best practice today and will be a mandatory requirement in the near future. Berlin Risk sets high quality standards in conducting comprehensive integrity due diligence investigations, and has assembled vast amounts of experience in researching and assessing ESG risks. We already know what to look for, we always go the extra mile and we specialise in connecting the dots. The graph below shows ESG as a holistic concept of integrity. We believe that ESG due diligence and ESG risk assessment also require a holistic approach.

Case Study

A company seeking venture capital was considering an international investor. It asked Berlin Risk Advisors to confirm the investor’s business partners to identify any concerns regarding the source of funds.

Research into the ownership structure of the investor revealed a minority shareholder that had been associated with serious ESG issues in Central America. This shareholding company faced allegations of environmental pollution through mining, causing health hazards, human rights violations including the use of repressive measures against protesters, as well as corrupt practices aimed at preventing legal proceedings.

Although the minority shareholder had not faced any criminal charges in the Central American country, the client concluded that the evidence of ESG violations did in fact infect large parts of the funds in question. Ultimately, they decided not to engage further with the investor.

Investigation

Berlin Risk offers a portfolio of corporate intelligence solutions, which can be tailored precisely to meet the challenges of your project.

Advisory

We can help businesses operating internationally to analyse and assess the political and regulatory risks at the national and sector levels in the regions in which they operate.